As you may probably know, the level of non-farm employment change or non-farm payrolls (NFP) will be released today at 15:30 MT time. It is the leading indicator of consumer spending, that is why it can influence the USD significantly.

The NFP in August reached 201,000 payrolls.

Let’s check what major banks predict about the September digits:

Goldman Sachs – 175,000.

“Strong September employment report, decline in the unemployment rate, firm average hourly earnings, despite the hurricane Florence”

Morgan Stanley – 178,000.

“Growth of the employment level, the lowest levels of initial jobless claims, limited hurricane Florence impact”

Amherst Pierpont – 190,000.

“A slight decline due to the hurricane Florence influence”

Wells Fargo – 210,000.

“Repeat of the August levels, record low levels of initial jobless claims, decline in unemployment rate to 3.8%”

If actual figures are greater than the forecasts, the USD will increase.

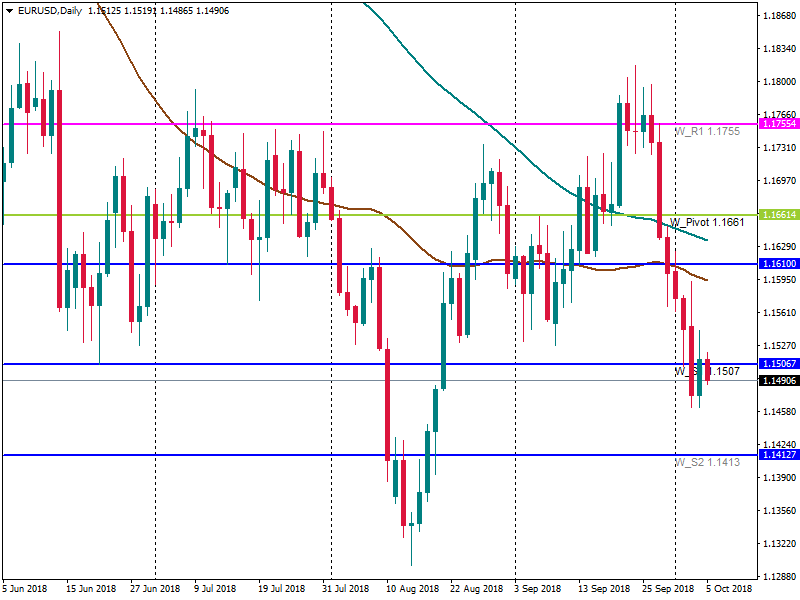

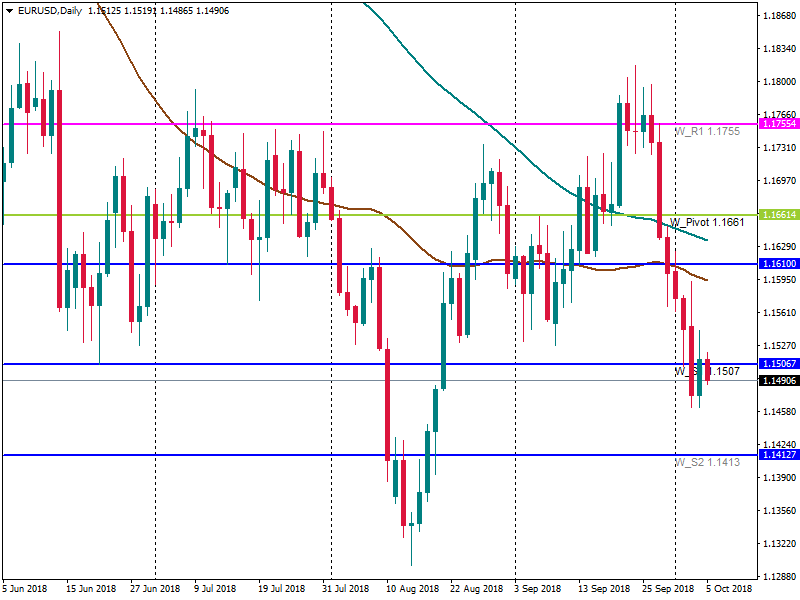

Up to now EUR/USD is falling towards the support at 1.1413. If NFP beats the forecasts, the pair will fall below this level. Otherwise, it will go above the resistance at 1.1507.