The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

2020-05-06 • Updated

The German court made a surprising decision on May 5 that the European Central Bank's mass bond-buying violates the German constitution. EU executives said that EU law takes precedence. Let’s see who’s right and who’s wrong.

The most important thing is that this situation has made euro very volatile. Investors observed the court decision closely, that’s why EUR/USD fell immediately after it had been released.

In 2010 the ECB’s mass bond-buying program started to support Greek economy.

In 2015 the bank launched the 2.7 trillion-euro Asset Purchase Program (APP). Those purchases had to be proportional to the relative size of each EU economy.

In 2020 the 750 billion-euro program was created to support the eurozone amid the coronavirus pandemic.

The court ruling refers to the 2015 APP, but not purchases in the coronavirus crisis. However, it can have the huge impact on the eurozone as Germany may pull out of the next ECB's bond purchases.

There is the EU rule that forbids one member to pay directly for the debts of another one. The ECB has found how to avoid this rule: it buys government debts in secondary markets. However, everybody can notice this huge imbalance in the eurozone. Germany is tired of subsiding other EU members and then suffering from it. This help slows down their national economic rebound from the crisis and leads to the weak euro. The ECB credibility is under threat now as Germany is the cornerstone of the eurozone.

The German bank gave the ECB the three-month deadline to explain that the ECB's purchases were "proportionate". For these three months the bond purchases will remain unchanged.

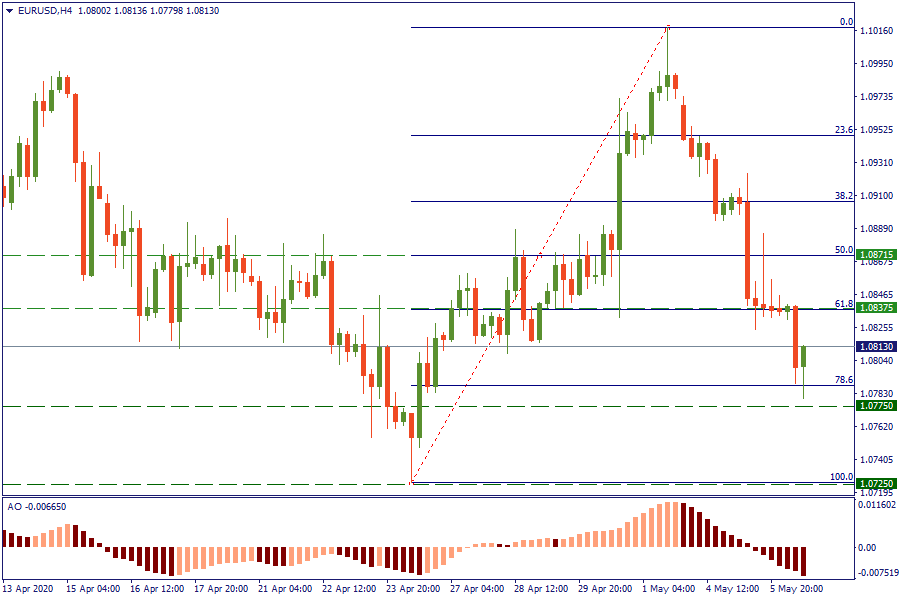

Let’s look at the EUR/USD chart below. The price is moving aggressively down to its recent low level on 1.0725. It even broke through 61.8% Fibonacci level or 1.0837. It looks like it will continue its falling further. However, if it reverses and reaches the 1.0871 level, EUR/USD will increase. Support lines are on 1.0775 and 1.0725.

The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

The oil prices rally and world central banks’ dovish monetary policy caused by the Covid-19 pandemic were the main reasons for current inflation growth…

Last Friday’s NFP was disappointing. The reaction of the markets was astonishing. Will it last longer? Let's find out the main trade opportunities for the upcoming week.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!